Are you a Self Storage Property Owner who is Coming to a “Fork in the Road”?

Consider a Tax-Advantaged Exchange for Shares in National Storage Affiliates REIT!

A Compelling alternative when your financing matures or you’re considering selling your self storage property.

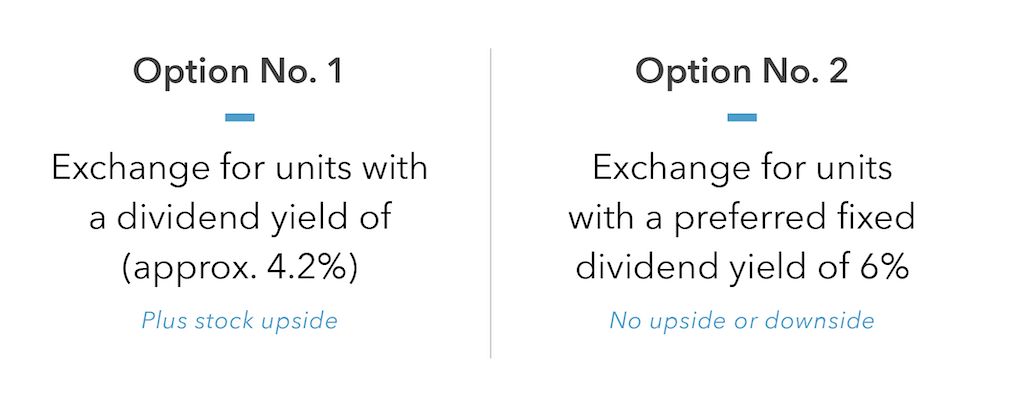

As one considers alternatives when thinking about transitioning out of your self storage property driven by: loan maturity, retirement, needed liquidity event, concerns about large tax liability; there is a unique option that you may not have thought of… a tax advantaged exchange of your property for National Storage Affiliates (NSA) Operating Partnership Units (OP Units). These OP Units are exactly equivalent to NSA REIT common shares and provide priority cash flow in a couple of ways.

Here are some additional advantages for exchanging your property for ownership in NSA:

- Enjoyment of the full equity value and cash flow generated from your property vs. selling and paying a potentially large tax bill and trying to replace the cash flow stream.

- NSA pays off your debt removing you from further personal liabilities.

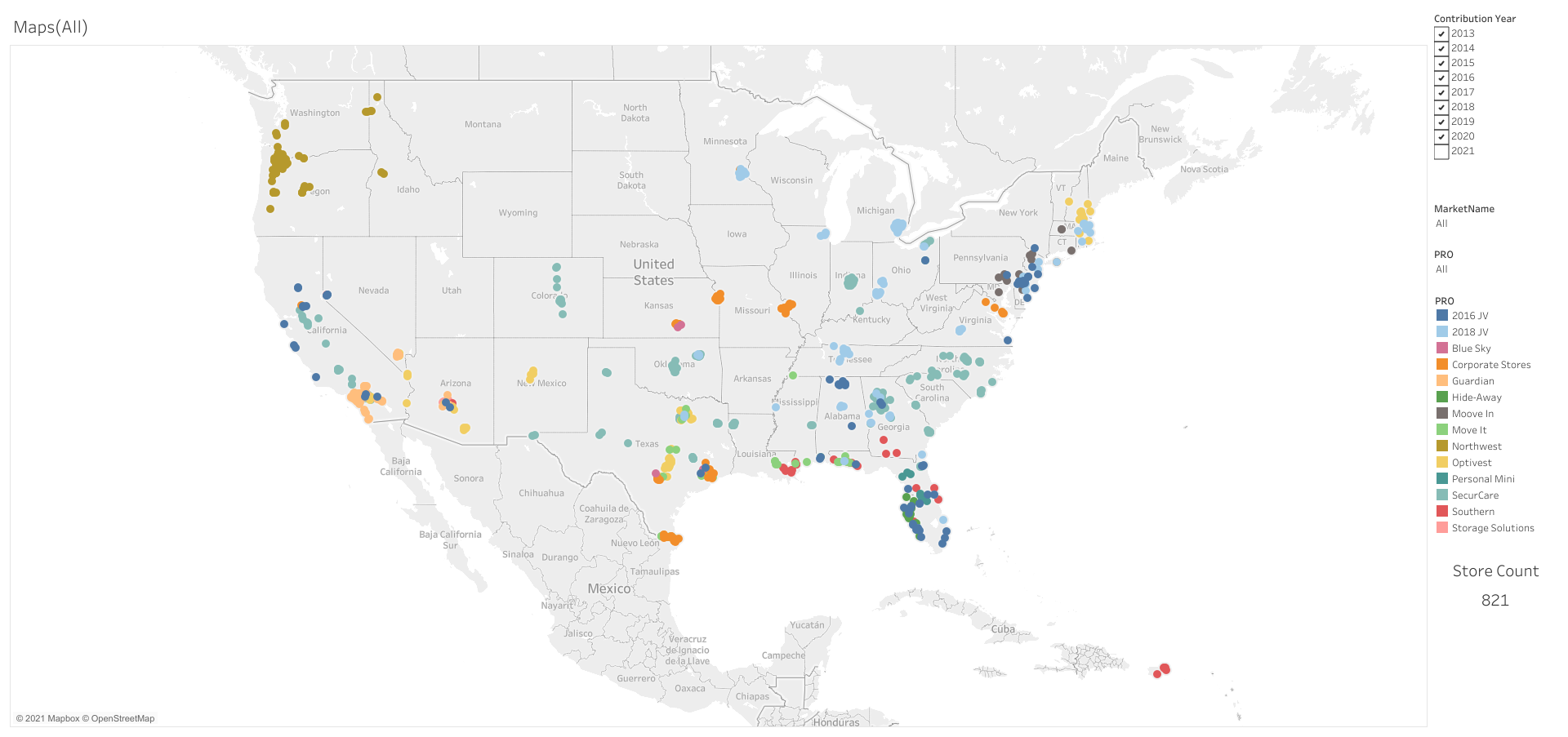

- NSA is a strong, Institutional quality portfolio owner that is geographically diversified across the United States.

- NSA’s Senior Management has long term, deep industry experience.

- OP Units are liquid instruments (traded on the New York Stock Exchange) and can be converted to cash any time after a 1-year lockup period.

- The contribution of your property is tax-advantaged:

- No tax liability until OP Unites are converted to REIT shares and sold.

- OP Units provide significant estate planning and charitable giving flexibility.

- Diversify your investment risk over a REIT with 820+ properties (see map below)

If you’d like to learn more about this program, please contact NSA’s advisor:

If you’d like to learn more about this program, please contact NSA’s advisor:

Curt Fleming

Knightsbridge

949-719-1994 Office

949-500-6152 Cell